As a tourist arriving in Vienna (or any other part of Austria) from outside the EU, you are entitled to a VAT refund upon leaving Austria to return to your home country. To receive the refund, you must meet certain conditions, follow the process correctly during your stay, and declare your purchases before leaving the EU via Vienna International Airport. In this way you can save up to 15% of your purchase total in Vienna or across Austria.

In this article, we will detail how to perform the VAT refund and how to do it digitally at the airport, or even within Vienna itself the day before your flight. This way, you can save money on your trip even if your flight is at a time when the airport tax refund desk is unstaffed.

What is required to be eligible for a tax refund (VAT) in Austria?

-

Age: You must be 18 years of age or older.

-

Residency: Permanent residency outside the EU and entry into the EU with a third-country national passport.

-

Minimum Amount: Each receipt for which you want a refund must be over €75.01. Multiple small receipts cannot be combined. Every receipt must show the percentage of tax paid.

-

The Form: At the time of purchase, the store clerk must fill out a tax refund form with all relevant details (name, address, passport).

-

Purpose: Purchases must be for personal use, not commercial.

-

Condition: Items must be new and unused.

-

Customs Stamp: Before departure, you must obtain a customs stamp on the tax refund form for all eligible purchases. This can be done digitally.

What is the VAT rate in Austria?

In Austria, there are three VAT levels. Different products have different VAT rates:

-

20% – The standard VAT rate for most products and items sold in stores.

-

13% – Art objects and antiques.

-

10% – Food and books.

For most of your shopping, the relevant rate will likely be 20%. Note: After deducting fees and service charges, you will typically be left with a refund of about 15% on purchases where the VAT is 20%.

Which companies provide tax refund services?

In Vienna and Austria in general, there are two main service providers:

-

Global Blue (www.globalblue.com)

-

Planet Payment (www.planetpayment.com)

With their help, you can receive the money in cash or via bank transfer (after fees).

How does the tax refund process work?

During the trip: When shopping at participating stores, if your purchase is over €75.01, ask the clerk for a tax refund form. You must keep this form along with the original receipt. Keep them organized and legible to ensure you can get your customs stamp. Note that refunds apply to physical products, not services.

Before leaving Vienna: You must present your original receipts and fill out a concentrated tax refund form. You then need to have the form stamped by customs and provide bank details (note that there are conversion fees) or visit a refund desk for cash.

Fast Filling: Global Blue offers an app where you can enter your details and get a barcode for stores to scan, filling your details instantly.

How do you know which stores offer a tax refund?

You can check the Global Blue app for a list of stores or look for the “Tax Free” sign with the Blue or Planet logo near the register. Most major chains participate.

Digital Customs Stamping

Vienna Airport offers a service called DEV (Digital Export Validation). You can declare your purchases online via your phone or at self-service kiosks at the airport. You only need to visit a staffed counter if your purchases do not appear in the digital system.

This is how the purchase verification via mobile phone works

This is how the purchase verification via self-service machines works

Getting the refund at Vienna Airport

-

Arrive Early: Ensure you have enough time before your flight.

-

Checked Luggage: If your items are in your checked bags, you must complete the process before checking them in.

-

Carry-on: If you have only a carry-on, you can do this after passport control near the gates.

-

Agent Fee: Processing by a clerk costs €7 extra, and cash is not available through them – only bank transfers. More info about it here.

-

Cash: For cash, visit Interchange stations at the airport.

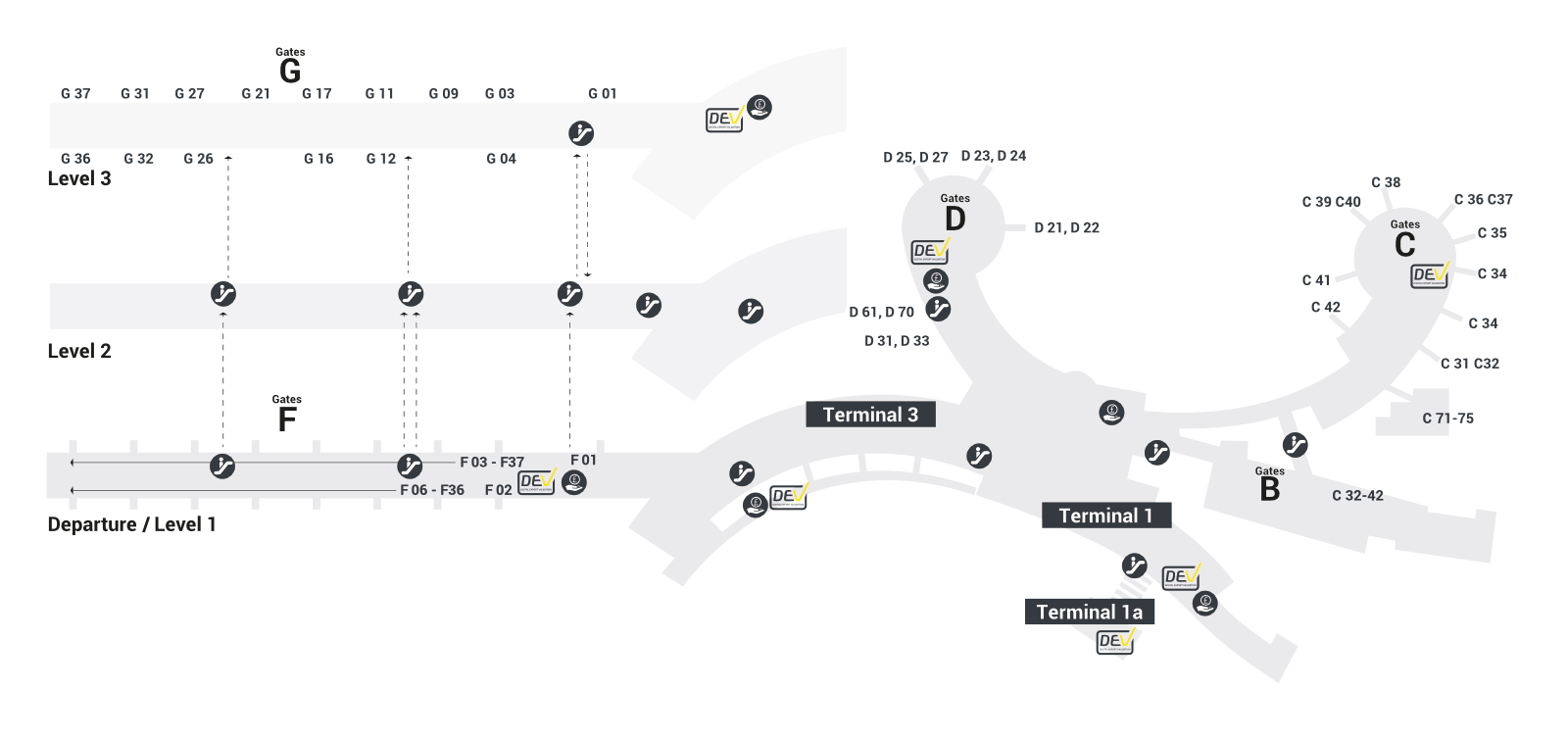

This is a map of the DEV desks at Vienna Airport, where you’ll find self-service machines, a staffed counter, and the option to complete the validation via your mobile phone for the tax refund:

Please note: If any of the required information is filled out incorrectly or is missing from your tax refund form, or if the items you purchased are not with you at the time of declaration, the tax refund will not be possible.

Tax refund in the center of Vienna

If you want to avoid airport stress, you can visit refund stations in the city center:

-

Global Blue: Located in the 1st District at Domisol, Peek & Cloppenburg. More info.

-

Planet: Located in the 1st District at STEFFL Department store (5th floor). More info.

What should you do if your flight is in the middle of the night or very early in the morning?

In that case, you can complete the refund process the day before your flight at the refund counters inside Vienna, or arrive a bit earlier and do the process using the self-service machines or via your mobile phone at the tax refund desks at Vienna Airport.

Processing Fees

The companies handling refunds charge fees that are unfortunately unavoidable.

-

Bank/Credit Transfer: If the refund is in a different currency (e.g., Euro to NIS), a 2-4% conversion fee applies based on the provider’s rate. Total fees can reach 6-7% of the refund amount. Credit card refunds (Visa/Mastercard) have an extra €1 fee per form.

-

Cash Refund: Fees range from €3 to €30 depending on the amount. For refunds between €80 and €500, expect a 6% fee.

Planning to go shopping in Vienna? Read about the most recommended places for shopping in the city. Additionally, if you are interested in shopping at Primark, you can read about the three Primark stores in the Vienna area. For those looking for brands, you can travel to the Parndorf outlet. You can also read more information about Vienna Airport and ways to reach it throughout the day.